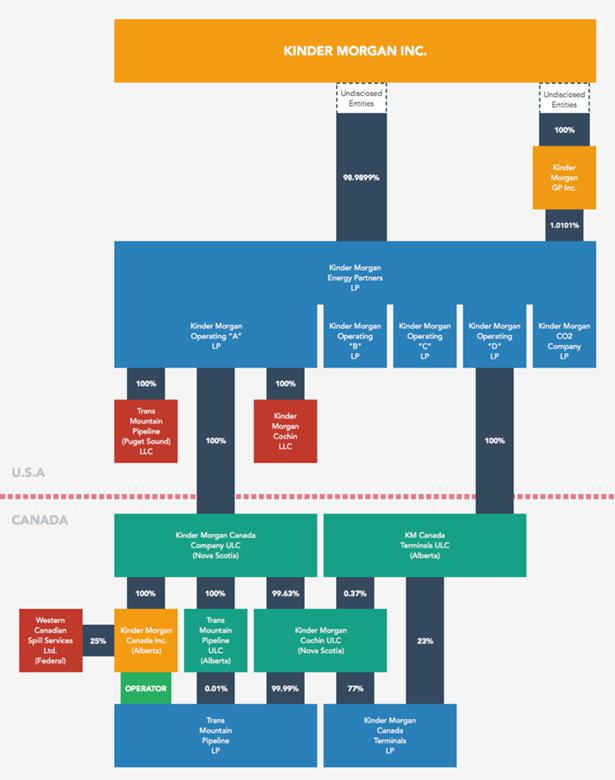

While doing work as an Intervenor for the Board of Friends of Ecological Reserves in the National Energy Board hearings on the Kinder Morgan Trans-Mountain Pipeline Expansion proposal , we have received notice throughout the past few months of the posting of many motions and questions to the Board from Intervenor Robyn Allan. The incredible amount of research she has done may be accessed on the NEB website: https://docs.neb-one.gc.ca/ll-eng/llisapi.dll/Open/2451015

By Robyn Allan, Monday, January 10– TheTyee.ca

U.S.-based Kinder Morgan says its Trans Mountain expansion project represents financial and economic benefit to the Canadian economy, and our federal and provincial public treasuries.

Who would spend a year investigating such claims, rooted as they are in complex tax law, regulations and corporate structure? I did.

What I found made me conclude the opposite — Kinder Morgan drains financial wealth from our economy and does not pay its fair share of taxes.

I have written about the project’s complicated design to yield meagre tax revenues for Canadians in a previous Tyee article.

Now let me examine just how Canadian Kinder Morgan Canada Inc. is. The answer: hardly at all.

Pop the hood and take a look at Kinder Morgan’s inner workings and the idea that this is a Canadian company operating for the good of Canadians is dispelled quicker than Kinder Morgan can say injunction.

If you are bored by arcane discussions of corporate structure and governance, that may be just what Kinder Morgan is hoping. Please bear with me. It’s critical we know who really runs, and benefits from, Kinder Morgan Canada Inc. —From the boys who brought us Enroncontinued at: http://thetyee.ca/Opinion/2015/01/12/Trans-Mountain-Texas-Profits/

Click to enlarge (some browsers may require a second click to further enlarge image). Kinder Morgan corporate chart prepared by Robyn Allan. Graphic design by Karl Jensen.